Korea's AI Chip Ambitions Get a Boost with Rebellion-Sapeon Merger, Buan Earthquake, Korean Investments Surge in Central Asia

Merger of Rebellion and Sapeon Korea AI Semiconductor Startups, Magnitude 4.8 Earthquake in Buan, North Jeolla Province, Surge in South Korean Investments in Central Asia

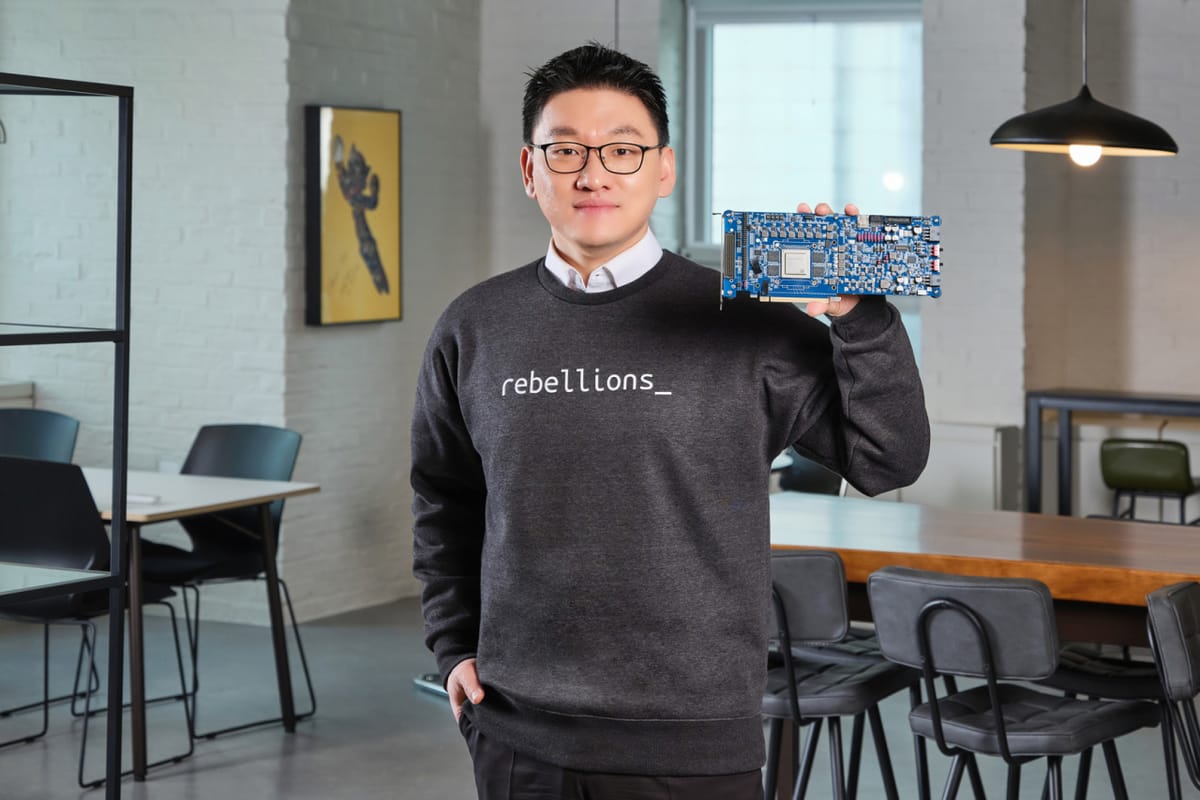

Merger of Rebellion and Sapeon Korea AI Semiconductor Startups

In a major development for Korea's artificial intelligence (AI) chip ambitions, leading neural processing unit (NPU) design startups Rebellion and Sapeon Korea agreed to merge on June 12. The merger, spearheaded by SK Telecom, the largest shareholder of Rebellion and parent company of Sapeon, aims to create a "national champion AI semiconductor company" targeting the global market. Both Rebellion and Sapeon Korea specialize in NPU design, with Rebellion's NPU being used in KT Cloud's domestic NPU infrastructure. NPUs are expected to replace GPUs in generative AI applications due to their low-power and high-performance advantages.

The two companies believe the next 2-3 years provide a golden opportunity for Korea to gain an edge in the rapidly growing AI chip market, necessitating a quick merger. Due diligence and shareholder approvals are still needed, with the main contract targeted for Q3 and the integrated company launch planned for later this year. Interestingly, Rebellion, not the SK side, will lead the management of the merged entity, as startups are seen as more nimble in the fast-changing industry compared to large corporations. Both SK Telecom and KT, which recently invested in Rebellion, will remain strategic investors post-merger.

The market and competitive landscape remain challenging, with major players like Nvidia, Intel, Qualcomm, Google, Apple, and Amazon all developing their own AI chips, often in partnership with Samsung and TSMC

The merger underscores the strategic importance of AI semiconductors for Korea, which has identified them as a key technology foundational to its competitiveness in AI and the digital economy. Domestic supply is seen as critical amid global chip tensions and shortages, with the generative AI boom fueling demand and investments. Samsung and SK Hynix are also investing heavily in AI chips, while the government is providing support through initiatives like the AI Semiconductor Strategy, which aims for a 20% global market share by 2030. Korea is looking to leverage its strengths in memory chips and foundry to create synergies with 5G, data centers, cloud, and autonomous vehicles, with significant job creation and economic growth potential.